Job Order Costing Vs Process Costing

Process costing aggregates costs, and so requires less record keeping. Process cost systems have a work in process inventory account for each department or process.

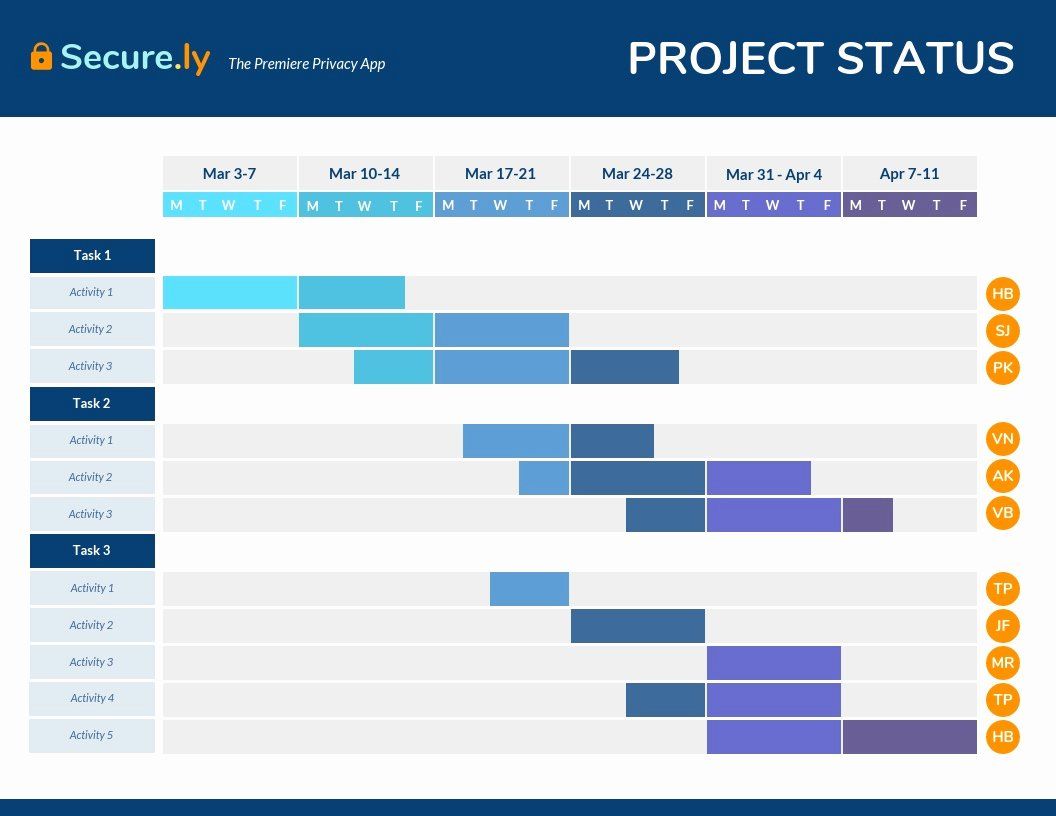

Business Feasibility Study Template Unique 11 Gantt Chart

Cost accounting is usually fairly simple in these systems.

Job order costing vs process costing. A hand carved marble statue would get job order costing. Job order costing looks at how much an individual item costs to manufacture. Job order costing is used in situations where clients require customized products, which means that each product or each unit of output is unique.

Much more record keeping is required for job costing, since time and materials must be charged to specific jobs. Job order costing is an accounting system that traces the individual costs directly to a final job or service, instead of to the production department. Job order costing is used when individual production centres or departments work on a variety of products rather than one king of a product during a specific period of time.

Differences process costing job costing product costs are assigned to departments (or processes). Job order costing and process costing. Labor and materials are entered on a job ticket.

The costs are accumulated by job. Job order costing and process costing both are applicable to keep up the expenses of direct material, direct worker, and assembling overhead. Process costing works better for.

Process costing is best for mass production industries with standardized products. The costing systems can be seen and are explained in more. Of course, as much as trying to process unique costs and incomparable units is ineffective, so too would attempting to cost each unit individually in a large series of identical products.

Job costing looks at each project in detail, breaking down the costs of labor, materials and overhead. Because process costing means products are produced in high volume, they lack individuality. However, in process costing, the cost of each job is determined.

This costing approach is adopted by entities that typically produce large quantities of homogeneous products or that provide repeated services of similar nature. In job costing, the cost is calculated after the completion of the job. In stark contrast, process order costing is something to be used when your product is not customised but rather is uniform, where the costs for each production will be the same, using the same amount of resources each time without any variance from job to job.

Cost ditetapkan secara terpisah untuk setiap job. Job costing is used in cases where products produced are unique, and process costing is used for the standardized products produced. Overhead is usually added to the amount the customer will be charged for labor and materials.

Job costing is best for industries where products or services are customized based on consumers’ demands. Process costing takes each stage of manufacturing (each process) and. With job costing, there may or.

Job costing is used for very small production runs, and process costing is used for large production runs. Unit costs are recorded by job on a cost sheet that follows the job through the production department. These cost systems differ from entity to entity but most are based on one of the two.

Through the below determinants of job costing and process costing,. Process costing looks at the cost of making thousands or millions of individual items. Process costing, on the other hand, is used in situations where all the products being manufactured are similar.

Job order costing versus process costing. Dilakukan terhadap perintah atau permintaan khusus. Unlike job order costing which ascertains and allocates cost to individual jobs, a process costing system involves ascertaining, accumulating and allocating costs to the whole manufacturing processes of the entity.

The main difference between job order costing and process costing is the situations in which they are applied. A process cost system (process costing) accumulates costs incurred to produce a product according to the processes or departments a product goes through on its way to completion. Job order costing process costing;

Costing systems provide cost data to help managers plan, direct and motivate, control, and make decisions (garrison). It is used when goods are made to order or when individual costs are easy to trace to individual jobs, assuming that the additional information provides value. One main difference between job order costing and process costing is the product type and the uniqueness of the product evaluated.

In job costing, the cost is calculated for each job, but in process costing first of all the cost of each process is calculated which is then dispersed over the number of units produced. Job order costing and process costing. Job order costing vs process costing.

Job cost systems have one work in process inventory account for each job. Lots of jobs are worked on during a given period, and each job requires different things from production. As we saw, there are two traditional costing methods that companies use to assign costs to the products and/or services that they provide:

Job costing is more likely to be used for billings to. Job costing is performed where the products produced of a specialized nature, whereas process costing is used where standardized products are produced. Job order costing is a cost system used to accumulate costs of jobs also called batches.

In job costing, losses are not separated, but with process costing, losses can be separated. A job order costing system is used when a job or batch is significantly different from other jobs or batches. Cost yang sudah terpenuhi untuk setiap proses untuk departemen berdasarkan waktu.

supply chain management dissertation supply chain Supply

Productivity Calculation Excel Template If you manage a

Construction Lifecycle Project management, Project

Network Infrastructure assessment Template Elegant 8 Vital

6 Customer Journey Mapping Examples How UX Pros Do It

Image result for value chain analysis Program management

Describes Job Order Costing Managerial accounting

Pin on The Best Professional Templates

Get Our Example of Restaurant Order Forms Template in 2020

Use Journal Entries to Record Transactions and Post to T

Reasons for Workplace Policies in 2021 Workplace

Profit Loss Statement Example Unique assumptions for Your

Purpose of Tort Laws Torts law, Vicarious liability

Profit and Loss (P&L) Statement Template Download Free

Work Flow Chart Template Excel Flow chart template, Flow